Asset Management

We strive to offer attractive solutions to both institutional clients and intermediaries. Our commitment to active management allows us to invest based on our beliefs. This enables our highly specialised teams to help generate value for our clients. We develop strategies and solutions covering equities, bonds and multi-asset investments.

What have you told us

We asked our community about their concerns.

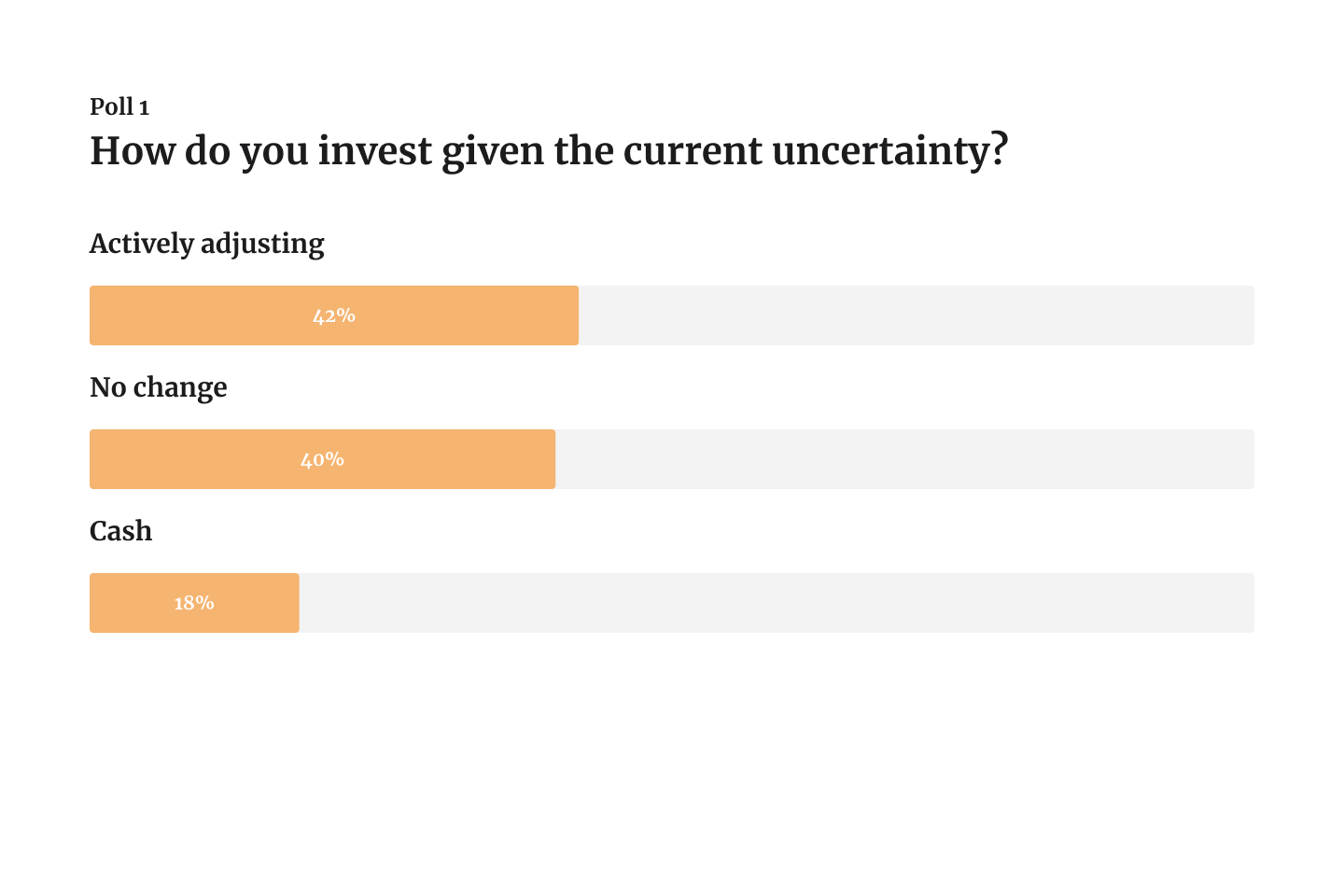

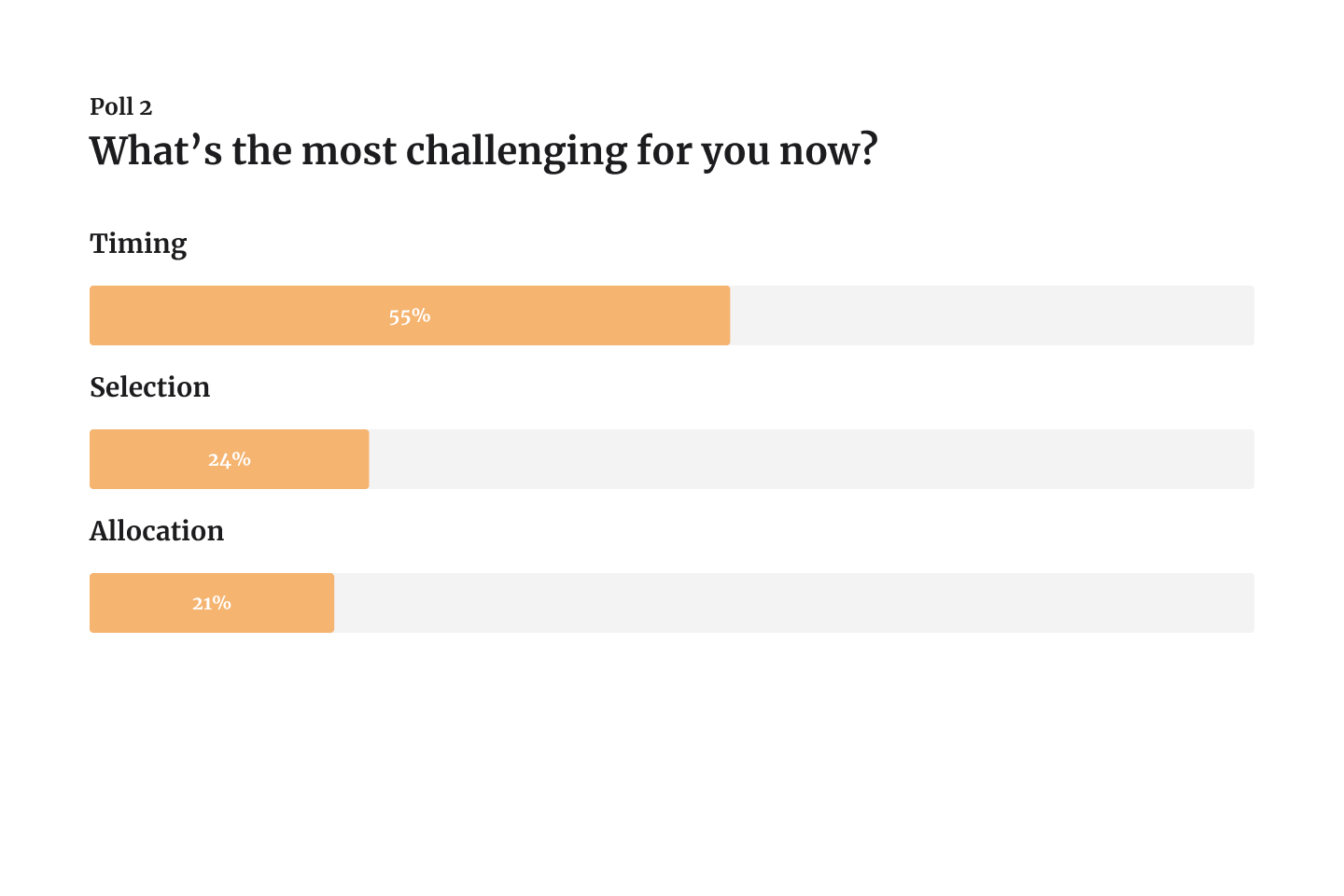

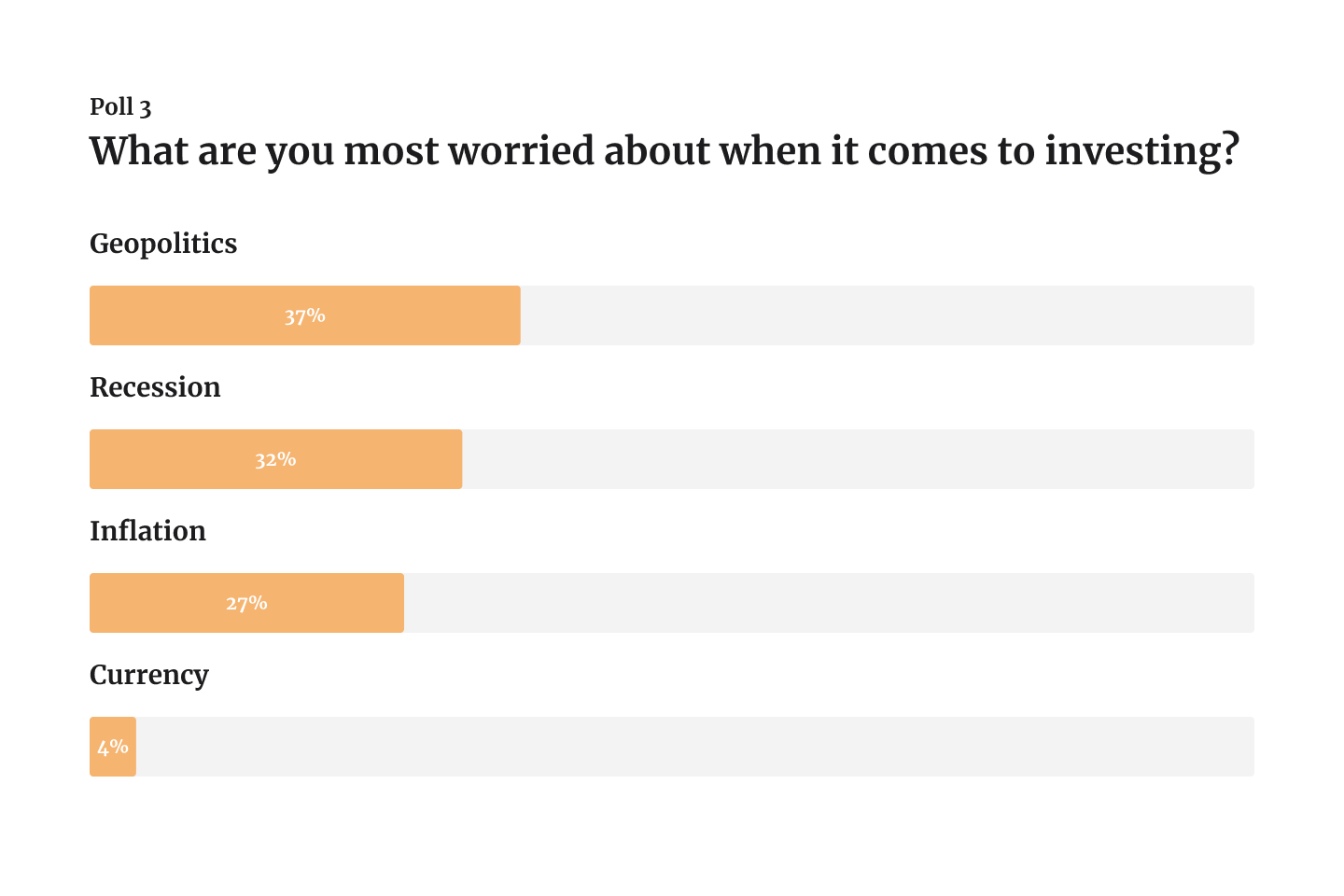

More than two-fifths responded that they are actively adjusting their investment strategies to reflect the current uncertainty. The most challenging aspect for more than half of respondents is timing, followed by choice and allocation. They are most concerned about geopolitical events, recession and rising inflation.

Source: Surveyed 588 potential professional investors worldwide.

Survey period: 15 August to 1 September 2023

Setting your own path

We are now dealing with a unique combination of events - the pandemic, the conflict in Ukraine and the return of runaway inflation for the first time in decades. We aim to provide you with the knowledge, tools and investment options you need to make the best decisions.

The end of irrationality: global equities forecast for 2023

3 reasons to allocate to emerging market equities

How to achieve Net Zero – striving to achieve our goal